Help your employees start taking steps toward a financially secure future today

|

|

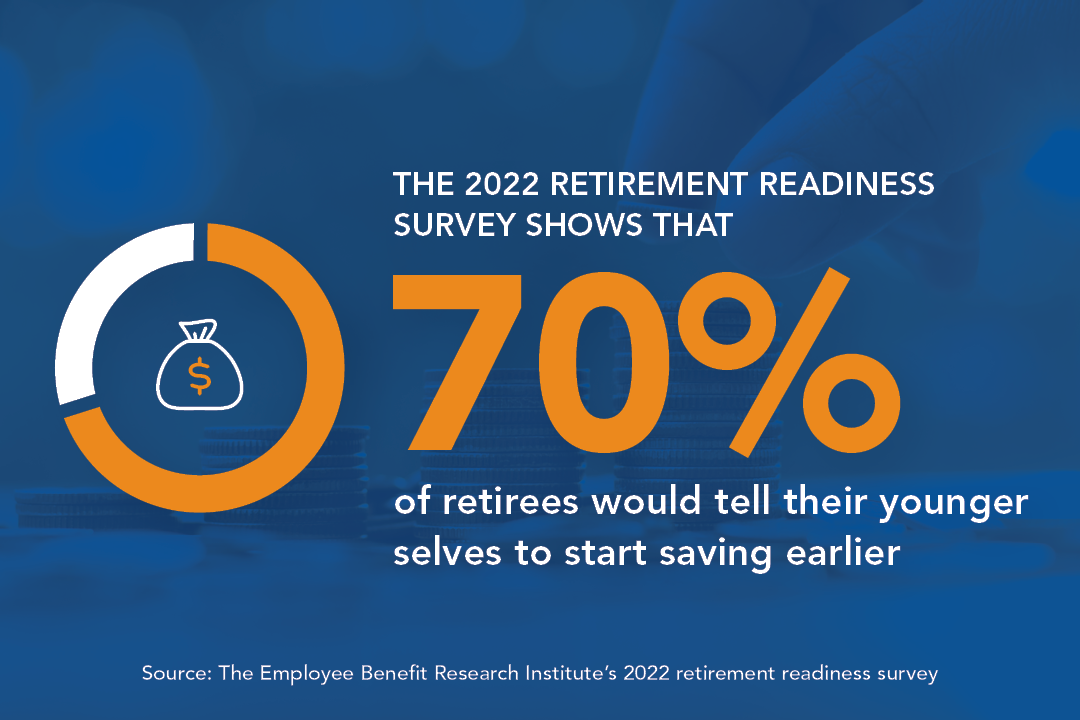

Will your employees’ retirement outlast their savings?Whether someone is 25 or 55, it is vital to seriously consider a proper saving plan to allow for a comfortable and financially secure life after retirement. We understand it can be tempting to put saving for retirement on the back burner when there are other top-of-mind financial concerns like paying down existing debt, lack of emergency savings and inability to meet monthly expenses. But the longer your employees put off planning for your future, the farther they will fall behind. It’s never too late to start! |

|

Invite your employees to join our upcoming pre-retirement planning seminars

Session 5 - Estate planning basics |

Session 6 - Managing the transition to retirement |

To be financially ready to retire, employees should SAVE ABOUT 11 TIMES their pre-retirement salary by age 65.*

Help your employees plan for retirement

We at USI Consulting Group (USICG) have a robust library of retirement and investment resources to help educate and assist retirement plan participants in managing their retirement accounts and setting a plan to reach their post-work life goals.

Para acceder a los recursos que aparecen a continuación traducidos al español, haga clic aquí.

If employees can’t tackle their short-term goals, they won’t be able to start thinking about retirement.

- A budget by any other name

- A checklist for the New Year

- Be smart about working remotely

- Buying a new car? Be careful of dealer add-ons

- Can’t save more? What’s stopping you?

- Carrying a mortgage into retirement — a good or bad idea?

- Changing your job? Don't overlook potential tax issues

- Get your bucks in a row

- Helping to care for aging parents

- Holiday budget: It's not an oxymoron

- How young adults can establish credit

- Know your net worth

- Loss of a loved one financial checklist

- Maintain a good credit rating

- Major changes to 529 college savings plans

- Retirement or student loans — Where should your money go?

- Retirement or your child's college education?

- Shrinking a mountain of debt, one piece at a time

- Workers less confident about their ability to retire comfortably

Tax Tips

With the right strategy, your employees can help make sure their retirement savings last.

- A lifetime of investing

- Are you making these investing errors?

- Buy-and-hold as an investing strategy: Weight the pluses and minuses

- Charting a long-term course

- Diversification strategies: Would an egg carton be better?

- Do passive funds take the worry out of investing?

- Evaluating investment strategies

- Five strategies for tax-efficient investing

- Handling market volatility

- How couples can get on the same page (when it comes to investments)

- How rising interest rates can impact investors

- Inflation and your retirement security

- Regular rebalancing

- Timing the financial markets

- What are Target Date Funds?

Key considerations when retiring to ensure financial security through the years ahead.

- A heads-up for the soon-to-retire crowd

- Dealing with debt before retirement

- Inflation and your retirement security

- Look into the future

- Making up for lost time

- Managing savings: Will your money last?

- Plan to work past retirement age?

- Planning for health care expenses 1

- Planning for health care expenses 2

- Postponing retirement

- Post-retirement investing

- Pre-retirement to do list

- Required Minimum Distributions

- Retirement: More than money

- Retirement security is not an impossible dream

- Social Security - Consider the source

Simple steps employees can take to reach their retirement goals and the future they deserve.

- Life lessons: Don't have a mid-career savings crisis

- Moving on? What will you do with your retirement plan?

- Pay yourself first

- Retirement savings tips for millennials

- Take the temperature of your retirement plan

- Top five things your retirement plan offers

- Turbocharge your retirement

- What's your retirement plan?

- What's your saving plan?

Opportunities and tips to help employees manage their finances and protect their nest egg.

- A retirement plan checkup

- Borrowing from your retirement plan

- Medicare: How and when to enroll

- Medicare: Parts A, B, C and D

- How and where to store important financial and personal records

- How do I choose between traditional and Roth accounts?

- How much life insurance is enough?

- Online shopping scams

- 2026 Retirement Saver's Credit

- Reviewing finances before remarriage

- Safeguarding your 401(k) account

- Strategies for first-time homebuyers

- Student loan ABCs

- Tax benefits — Go for growth

- The perils of cosigning a mortgage

- When marriage ends in divorce or separation

Estate Planning

Budgeting

Planning out your spending and living within a budget, is all about freedom. Learn how you can become more confident as you control your finances, prepare for unexpected expenses, and save comfortably for retirement.

Distribution Options

When leaving your job, you’re faced with an important financial decision on what to do with your assets. Learn about the various distribution options available as you consider leaving your employer or nearing retirement.

Learn more about distribution options

Investing for Women

Women face unique barriers when it comes to money. Some challenges include the gender pay gap and the demands of childcare. Learn about the myths and facts related to women and investing today, and why it is so important for women to have a retirement savings plan in place.

Learn more about investing for women

Mutual Funds

Understanding the investment options in your retirement plan may seem confusing, but it doesn’t have to be. Learn about stocks, bonds and cash equivalents and the risks associated with these types of investments.

Plan Loans

Planning for retirement is not only about what you put into your account, but also about when you take money out. Learn about the pros and cons from taking a loan from your retirement plan account, and the questions you should consider before taking a loan.

Roth Savings

Your retirement plan may offer investment flexibility that allow you to contribute multiple ways into your account. Learn the differences between pre-tax savings and Roth after-tax savings, and who should consider the Roth savings option.

Saving Concepts

Retirement readiness is largely about saving; dollar by dollar over your entire working career to potentially build the income you’ll need. Learn how life expectancy, social security, and inflation could impact how you save.

Learn more about saving concepts

Selecting Investments

Determining where to invest should not be based on a fund’s performance, but rather your retirement goals. Learn how to select investments based on your time horizon, financial need, and risk tolerance.

Learn more about selecting investments

Volatile Market

Staying focused on your retirement goals in a volatile market can be challenging. Learn the basic strategies used to help protect your assets during volatile times in the market.

Leverage these resources to help your employees understand the importance of preparing for retirement and ensure they are participating in their employer-sponsored retirement plan and saving for their future!

Why should employers care?

A key component of achieving financial wellness in the workplace is making sure your employees are financially prepared to retire. Employers have begun to focus on employee financial wellness to better understand the barriers employees face in saving for retirement. If employees aren’t able to tackle their short-term goals (i.e., pay down debt, establish emergency savings, afford healthcare), they won’t be able to start to think about retirement.

Your employees may not be speaking up and requesting help, but they need a financial well-being program that does more than offer online retirement income calculators or sessions with investment specialists. Employees need a financial well-being program that helps them improve their ability to live within a budget, reduce debt and save for the future.

Helping employees improve their retirement readiness can also help mitigate the projected economic costs to your business. Our article, Is Delayed Retirement Impacting Your Bottom Line?, reports that employers spend more than $50,000 per employee each year an employee delays retirement. A workforce that is financially unprepared to retire can impact businesses in a wide variety of ways, including potentially higher labor costs, increased health care premiums and lower productivity due to financial stress.

Access useful compliance resources

Take steps to help fulfill your compliance and fiduciary obligations by accessing our new Retirement Plan Compliance Resource Center featuring a compliance checklist, online calendar reminders and more.

How USICG Can Help You

USI Consulting Group has been helping employers enable their workforces to successfully plan and invest for retirement for over 45 years. To learn more about USICG’s solutions and how we can help you improve your employees’ financial security and retirement readiness, contact your USICG Account Manager or reach out to us at information@usicg.com.

* Source: T. Rowe Price, February 2023.